EMEA Snap:South Africa MPC preview -Expecting a hawkish hold

摘要: WeexpecttheSARBtokeepratessteady,butwitharesoundinghawkishtone.SincethelastMPCinJulytherandexchanger

We expect the SARB to keep rates steady, but with a resounding hawkish tone.

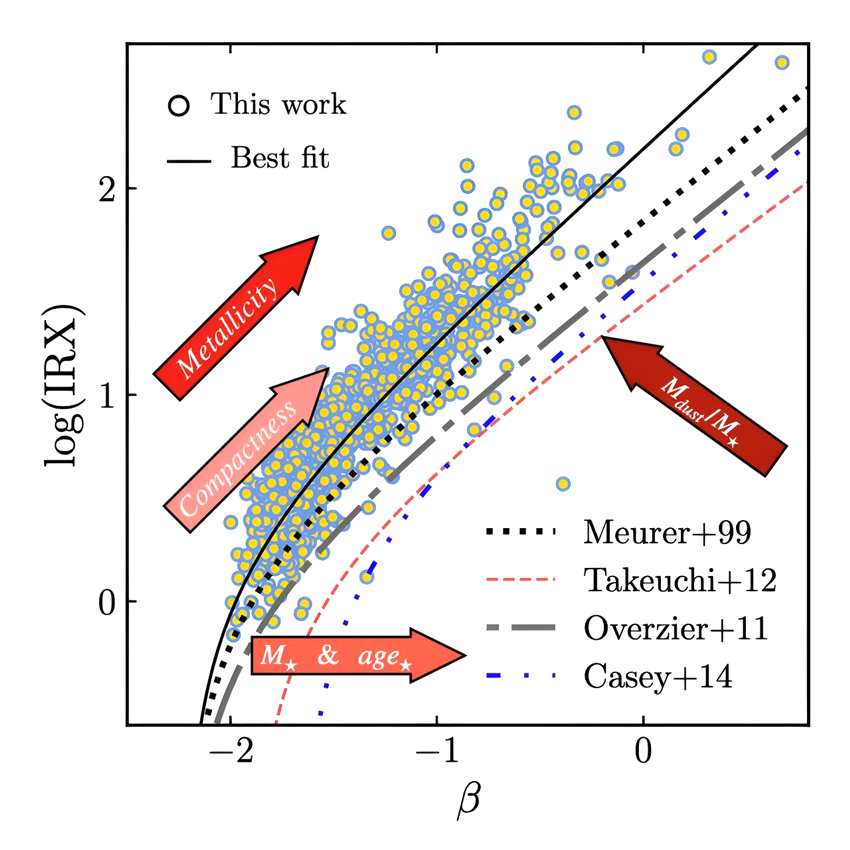

Since the last MPC in July the rand exchange rate appreciated marginally, oil prices receded slightly, maize futures declined and CDS spreads tightened further. Inflation prints continued surprising lower too. In light of oil-price-led disinflation in recent months, the SARB could revise its short-term inflation forecasts down by 0.3%-0.4%. However, there are also new inflation risks on the horizon, which could see next year’s forecasts revised higher (Fig 1&2). Political tensions have also raised the specter of a possible sovereign credit downgrade at the end of the year. So while the market is pricing a low probability of a hike next week (24%), and 100% of one hike over the course of the next 12 months or so, a hawkish statement could revive a steeper curve. While risks to our view have risen, we see SARB on hold until 1Q17 given renewed economic weakness in 2H16, and rate cuts of 50bps from 2Q17.

Despite recent oil price-led disinflation, the 2017 CPI outlook has deteriorated.

Given new information this week, medical aid tariffs could rise by 11-12% next year (vs 9.5% ave. 2000-2014) owing to financial pressure facing medical schemes. Lotto ticket prices went up by between 42% and 46% (16% ave) in May (possibly effective January 2017). Collectively, these changes have raised our 2017 inflation profile by 0.5% to 6.5%, while shifting the inflation peak from 6.9% in November to 7.1% in 1Q17 - a peak similar to the SARB’s existing profile. The target breach has extended to three quarters next year, and the likelihood of a sugar tax hike next year could also aggravate this trend.

Exchange rate risks hold the key to another rate hike in our view.

Despite depreciating 10% since the low point last month, the rand is still at similar levels compared to before the July MPC meeting. The SARB had stated at the time that spot levels were well below their existing exchange rate assumptions. Exchange rate volatility driven by external events tends to be less of a concern for the Bank than domestic events.

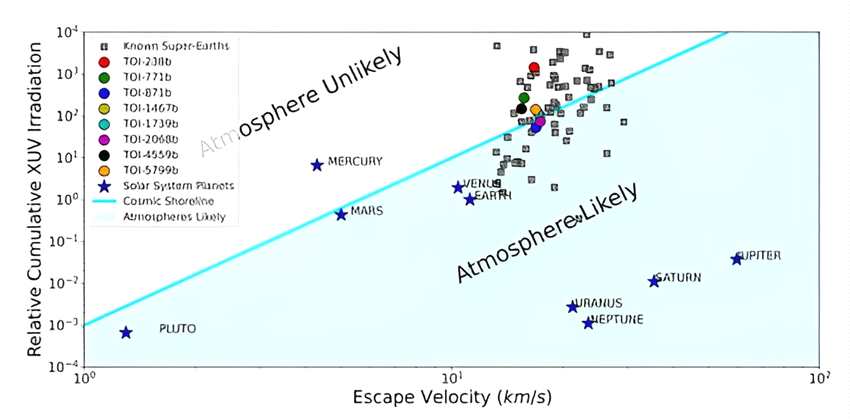

The SARB’s July rand forecasts (DB estimates) priced out a credit downgrade.

Using the Bank’s fuel and oil price forecasts we estimate that their ZAR forecast for 2016 was revised down from R16.63/USD (annual average) in May to R15.10/USD in July (Fig 3). The marked difference possibly reflects earlier concerns of a sovereign credit downgrade. These aggregates would imply year-end levels of c.R19/USD and R15.80/USD respectively - a 20% difference - in line with our view of a credit downgrade scenario and base case (no downgrade).

We don’t believe a sovereign credit downgrade is as good as done1.

Our year-end forecasts of R15.50/USD reflect general risk-off sentiment. Based on our estimates, the rand exchange rate can trade some 40% YoY weaker in the quarter of a downgrade (i.e. R19/USD - if a downgrade was to occur in December). These levels will clearly drive renewed inflation risks, which should result in further policy tightening (c. 1% -1.5%) in our view.

ave,USD,R19,WeexpecttheSARBtokeepratessteady,butwitharesoundinghawkishtone