Rights Wrongs&Returns:2H16~Investment Twilight zone

摘要: 1H16hasthusfarliveduptoourexpectations(YearofLivingDangerouslyandsequel)thatthismightbeawatershedyea

1H16 has thus far lived up to our expectations (Year of Living Dangerously and sequel) that this might be a watershed year that would redefine investment styles and reinforce our view that neither conventional mean-reversion, macro nor momentum investment strategies are likely to work. We believe that investors are residing in a ‘twilight’ zone between dying free market signals and the coming era of state-driven credit, capital investment and consumption.

In our view, investors’ predicament is driven by interaction of two powerful forces that preclude return to conventional business and capital market cycles.

First, there is a high global leverage. We describe it as a superstructure resting on top of the underlying economy, constantly interacting with it. Global economy has a debt burden of ~3x GDP and up to five times as much on a gross basis. This superstructure therefore has high and unpredictable in-built volatilities, interacting with the real economy and asset classes. Given our view that no major economy can any longer de-leverage, volatility is unwelcome as it undermines confidence without which further leveraging is not possible. Hence CBs heightened sensitivity to any significant bout of volatility that might ‘infect’ cross-asset classes. As a live ‘volcano’, Debt Mountain rumbles, pouring streams of lava that CBs work to isolate and contain. However, the need for leveraging works against CBs by raising both frequency and strength of tremors.

Second, we do not view the current lack of productivity, as a temporary phenomenon. Instead it is an inevitable outcome of LT secular shifts (Third Industrial Revolution), compounded by overleveraging and the unintended consequences of monetary policies to match stagnant demand with excess capacity. We maintain that lack of productivity will be a consistent theme for years to come. This will likely force CBs to maintain current monetary policies, as the only way to avoid demand contraction and ensure that asset values are rising to facilitate further leveraging. It is a classic ‘Catch 22’, as without productivity, leveraging is the only way to grow but it increases volatility, flattens yield curves, and undermines credit and in turn erodes growth rates.

We maintain that the only socially acceptable answer is what we call ‘nationalization of capital’, which in our definition implies state control over capital allocation and spending. It is premised on the replacement of a private sector that refuses to multiply money. Hence it will be perceived as the public sector’s responsibility to support aggregate demand. However, as in Gresham’s Law (‘bad money drives out good money’), an aggressive public sector lowers the visibility of the private sector, and unless it is perceived to be temporary, the impact is not just on visibility of demand but also on the economy’s single most important price (cost of money). It is another ‘Catch 22’ that ultimately leads to further capital misallocation, lower ROEs and either deflation/stagflation or hyperinflation. Alas, there is no alternative and public stimulation of consumption, infrastructure, R&D and bail out of the financial superstructure (all via direct CB financing) will have a strong impact. It also creates its own investment signals.

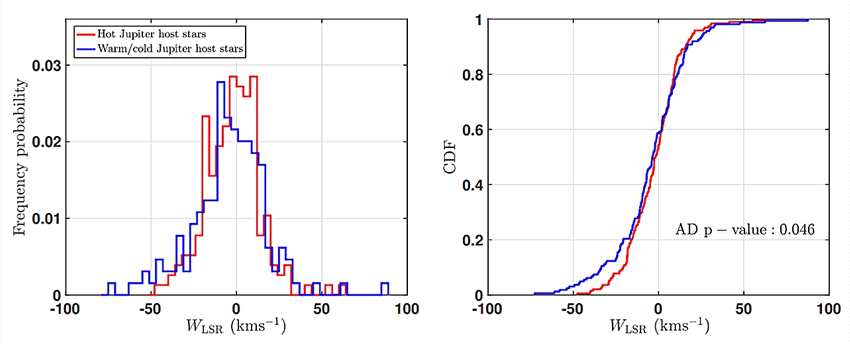

How does one invest? We maintain that conventional mean reversion strategies cannot work in the world of no conventional business/capital market cycles and, given cross-currents, macro calls are also no longer possible. We continue to highlight investment strategies based on ‘Quality Sustainable Growth’ and pure ‘Thematics’. Our Asia ex ‘Quality’ portfolio is up ~4% YTD and 28% since inception (’13) whilst our Global ‘Quality’ portfolio is up by ~1% since re-balancing in April and Global ‘Thematics’ is up by ~2% since launch (Jun’16).

However,Catch22,Thematics,Quality,H16hasthusfarliveduptoourexpectations