China Cement Weekly:Short-term Weakness in Cement Prices Entering the Summer Rainy Season;Momentum still Driven Mainly by Infrastructure

摘要: Cementpriceswentdownlastweek.Theaveragecementprice(nationwide)dropped0.25%week-on-weektoRMB257.25/to

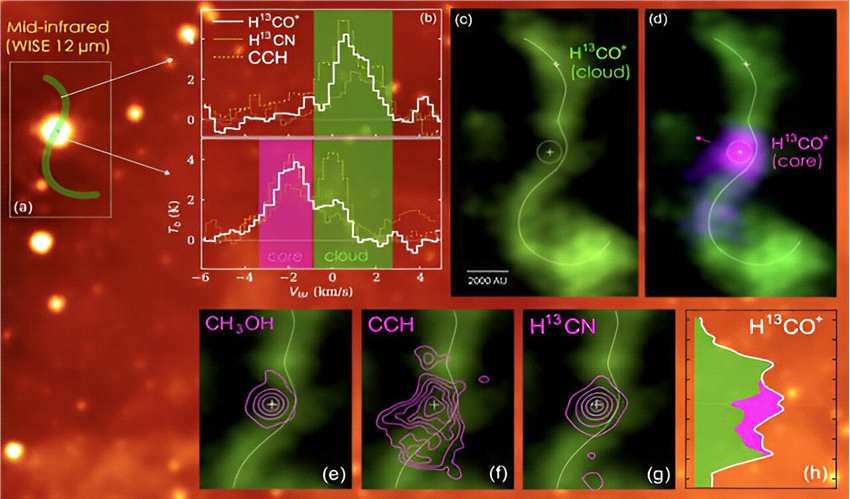

Cement prices went down last week. The average cement price (nationwide) dropped 0.25% week-on-week to RMB257.25/tonne last week. Cement prices in parts of the Pearl River Delta were up RMB15/tonne, while prices in the Yangtze River Delta fell up to RMB10-20/tonne. National cement prices continued the mild downward trend in June owing to the rainy season. Production limits were implemented in Shandong, Yunnan and Shaanxi to stabilize cement prices. Average inventory level (nation-wide) climbed slightly to 70.56%.

Coal prices stabilized last week. The comprehensive average price index for Bohai- Rim Steam Coal (Q5500K) stabilized at RMB400/tonne last week. The index was 4.3% lower on a year-on-year (YoY) basis.

5M16 cement production still up 3.7% YoY. Cement production totalled 885m tonnes in 5M16, up 3.7% YoY. Growth was 0.5ppt higher than that of 4M16. Though largely affected by the rainfall, production in May still reached 227m tonnes, up 2.9% YoY. Demand was driven mainly by infrastructure, while property momentum was capped by the stringent policies since April. Property development and investment in 5M16 saw a gentle upward trend for the first time this year, but growth was 0.2ppt less than that of 4M16. Growth in infrastructure investment still improved 1ppt compared with that of last month.

Given the continuing infrastructure momentum and largely stable property investment, we are still positive on the outlook for companies like Anhui Conch [0914.HK; BUY] and BBMG [2009.HK; BUY]. However, because of the traditional rainy season in June and July, we may see some short-term weakness in cement prices, especially in east China.

Cement stocks under coverage down 5.5% on average.Overall market sentiment remained weak last week. Best performer Anhui Conch was down 4.4%. CNBM [3323.HK;SELL] was the weakest among our coverage stocks, falling 6.6%.

YoY,HK,25,on,tonnelastweek