Asia Credit-Monday Tidbits:Fed &EM credit

摘要: HowhasEMcreditbehavedinpastFedhikes?WithapossibleFedhikearoundthecornerinJune/July(andwedon'thavethe

How has EM credit behaved in past Fed hikes?

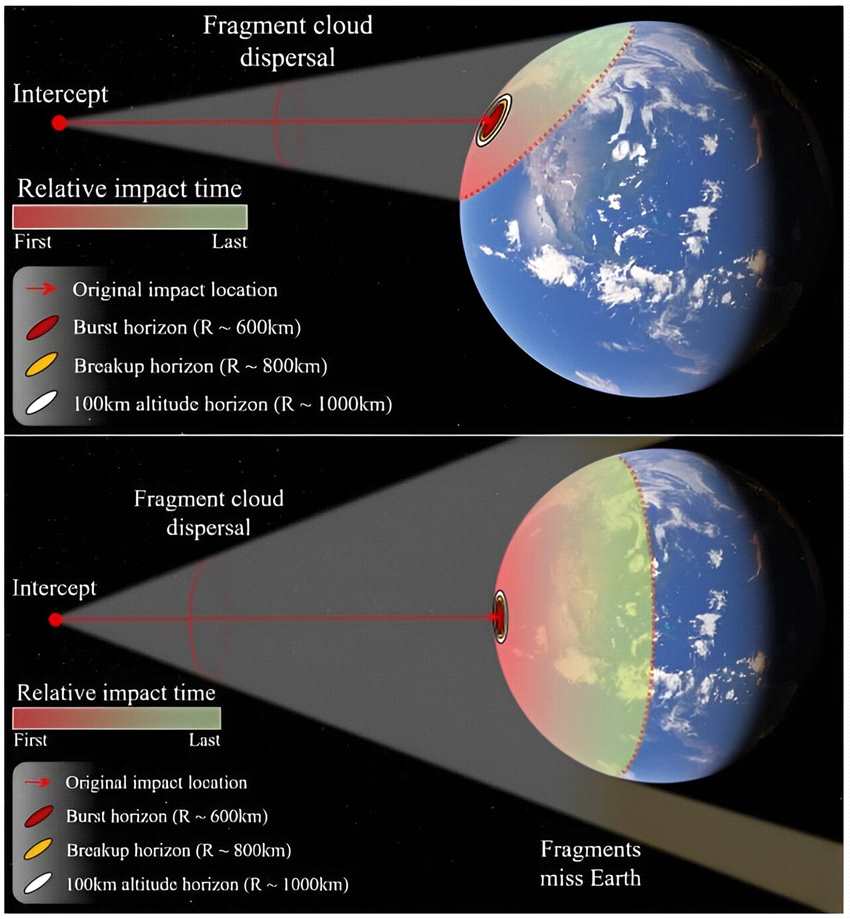

With a possible Fed hike around the corner in June/July (and we don't have thebenefit of seeing the NFP number as we write this), this is a logical questionthat comes to mind. Unfortunately our EM spread data doesn't go too far backin history, but we draw some observations from two episodes below - tapertantrum in 2013 and the hike late last year (Figure 1):- EM credit performed poorly in both instances, though they wereaccompanied by a broader risk off. We don't expect the impact to be asmaterial this time around (unless we get an unforeseen global shock andassuming it's a dovish hike!), but we do feel that markets are perhaps toocomplacement. Spreads haven't budged much despite hawkish Fed speak inrecent weeks. Another potential sign of complacency is that credit investorsare very long duration and consensus view seems to be that 10yr UST isunlikely to hit 2% even with a Fed hike;- The performance of IG vs. HY within EM is more mixed. IG underperformed in2013 as 10yr USTs went from 1.6% to 3%. However HY had its turn in 2015 asoil took another leg lower, which also led to Latam & Ceemea underperformingAsia. In 2013, the three regions widened almost the same amount. Separately,sovereigns tend to underperform corporates in such sell-offs and this trendcould be repeated again this time given heavy issuance in the sovereign spacerecently;- In both cases, DM did better than EM, particularly in IG. DB's US IG indexwas just around 5bp wider during those periods. With EM havingoutperformed DM credit so far this year, we wonder if the Fed could changethat, especially with a stronger USD, and the consequent negative feedbackloop from weaker EMFX and lower commodities. We do acknowledge thedecoupling between USD & Commodities (read Oil) off late, albeit will besurprised if it's sustainable. EM credit has historically been highly correlated toUSD & Commodities (as highlighted in our 2H Outlook last week);- EM hard currency credit did fare better than the local counterpart to nosurprise given EMFX weakness. More importantly, EMFX is already lower inthe past few weeks and credit has been outperforming. Will credit catch up?Note that RMB is already back to the lows, quietly.

EM performance YTD (Figure 2)While EM IG has performed broadly in line with US IG (~15bp tighter), HY hasdone much better (almost 100bp tighter vs. 75bp for US including energy and30bp excluding energy). Regionally, Asia has lagged, which is not surprising,as a lower beta play. Ceemea has done marginally better, despite the big rallyin oil as heavy issuance has likely offset part of that benefit. Ceemea issuancestands at about USD60 billion till date, as against USD87 billion in all of 2015.

Latam numbers are similar, but it is the top performer in EM, mainly becauseof Brazil. Sector-wise, we highlight that EM sovereigns overall are flattish forthe year. However, in Asia, sovereigns have done the best (relative tocorporates & financials). Time to sell Asia sovereigns?

Commodities,HowhasEMcreditbehavedinpastFedhikes,WithapossibleFedhikearoundthecornerinJune,July,andwedon