Adani Ports:Upgrading the 2020s to (Tactical)Buy

摘要: Adani2020s(Baa3/BBB-/BBB-)havewidened~50bpinthelastcoupleofweeksonthebackofS&PandMoody'schangingthei

Adani 2020s (Baa3/BBB-/BBB-) have widened ~50bp in the last couple ofweeks on the back of S&P and Moody's changing their outlook to negative.

We had highlighted this concern in our note on May 10 and saw G+215-225bpas the fair level on bonds in that event. IG markets overall are 5-10bp widersince then, making us revise our fair value target to G+225-230bp. At G+255bpoffer currently (as we write), they are more than pricing a negative outlook forus. Plus, technicals generally feel quite strong at this point for Indian IG names,especially shorter dated ones, given lack of supply. Hence, we upgrade themto a (Tactical) Buy. We see upside of 25-30bp from here. Longer term, we needto see deleveraging for a more fundamental conviction.

Key risk is a downgrade to HY by rating agencies in the future in absence ofdeleveraging, in which case, we foresee bonds widening to 250-300bp (asdiscussed in our last report). Other downside risks are forced selling frominvestors that can't hold HY bonds, related party transactions, aggressivegrowth appetite, relatively high leverage, slowdown in cargo volumes, supportprovided to group companies, etc.

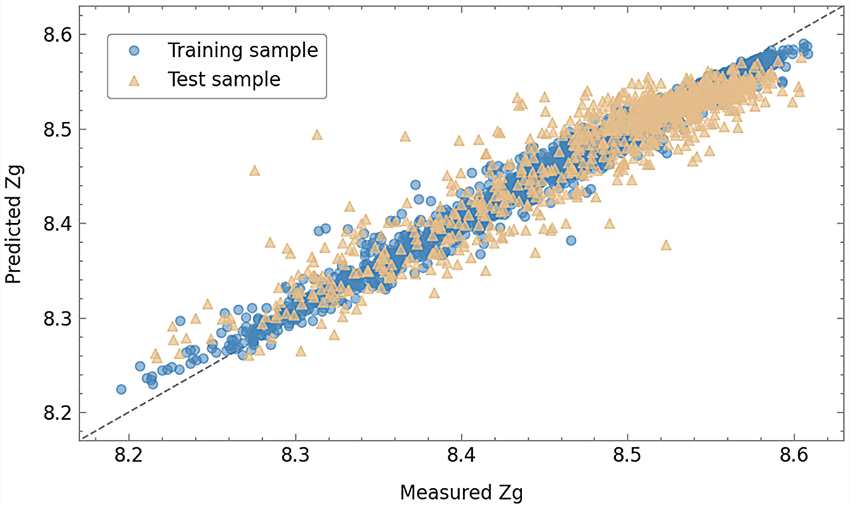

There are no perfect comps under our coverage, but Adani 2020s are thewidest trading in the Indian IG space in their maturity bucket (Figure 1). In fact,they are trading wider than the IDBI 2020s (Baa3/BB+/BBB-) and Tata Motors2020s (Ba2/BB/BB), which are already HY-rated by at least one of the agencies,albeit IDBI is partly government owned as of now. They are also wider than theonly other similar rated private sector Indian company, Bharti (2023s @G+200bp, Baa3/BBB-/BBB-). While Adani should certainly trade wider thanBharti, we note that Bharti bonds are 3 years longer.

Separately, compared to most other port credits like China Merchants 2020sG+165bp, Baa1/BBB+/NR), Pelindo III 2024s (G+255bp, Baa3/BB+/BBB-) andPelindo II 2025s (G+280bp, Baa3/BB+/BBB-), Adani bonds don't lookexpensive. We do acknowledge that all these comps have governmentownership.

In the event of an outlook change to negative on their Baa3/BBB- ratings,potential comps will be Bank of India 2020s (195bp) and Bright Food 2018s195bp).

BBB,bp,Baa3,BB,225