INDUSTRY UPDATE:Liquor sector treated as a defensive sector

摘要: Recoveryisontrack.Theliquorsector(bothspiritsandwine)isoneofthesectorsinA-sharemarketthatreporteddec

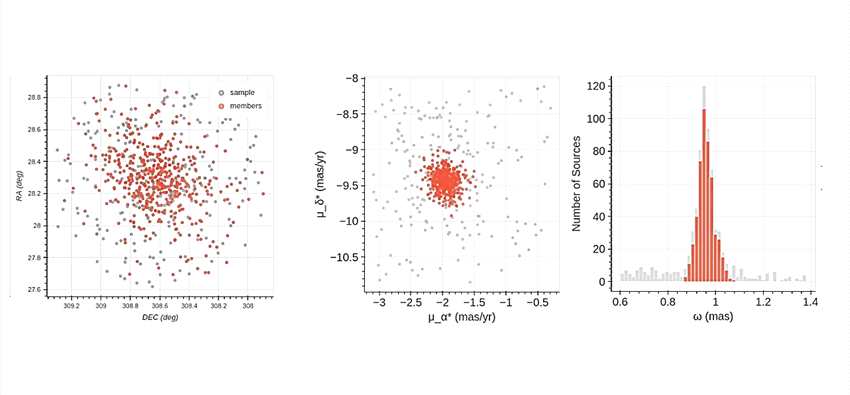

Recovery is on track. The liquor sector (both spirits and wine) is one of the sectors in A-share market that reported decent YoY netprofit growth in Q1 2016. Their earnings growth is due partly to the fact that the industry is recovering from the impact of the anticorruptioncampaign in 2013 and 2014. Government spending used to make up one-third of demand in the past, but now it hasreached a very low level after the anti-corruption campaign. The industry’s recovery is driven by increasing consumption by the massmarket, with demand coming from both individuals and businesses. According to WIND, the Chinese spirits industry resumed growthin 2015 after two years of adjustment in 2013-2014, partly because of the anti-corruption campaign. From Jan-Oct 2015, the Chinesespirits industry reported YoY net profit growth of 5.5% vs a YoY decline of 12.6% and 1.9% in 2013 and 2014, respectively. The resumptionof net profit growth was due partly to tight cost controls and more stable average selling prices. The wine segment also reportedacceleration in volume output growth in from Jan-Oct 2015, up 9,8% vs 5.3% in 2014 and a drop of 27.2% in 2013. Liquor(both spirits and wine) reported faster-than-average growth during the 2016 CNY holiday, which indicates that the growth momentumcontinues. The latest industry data is not available at this stage, but the Q1 results reported by the A-share listed liquor companiesshow the earnings recovery in the industry has continued in 2016. On average, the A-share listed liquor names, including KweichowMoutai, Wuliangye, Luzhou Laojian and Yantai Changyu Pioneer, reported YoY net profit growth of about 19% in Q1 2016.

Defensive sector with visible growth. In terms of share price performance, the A-share listed liquor names, on average, were up4.5%, 18.4% and 1.4% on a one-month, three-month and six-month basis, outperforming the Shanghai A-share market’s -5.1%, 2.5%and -22.3%, respectively. The market is treating A-share listed liquor names as defensive plays, as their earnings growth in 2016 ismore certain than that of other sectors. According to Bloomberg, the leading liquor names, including Moutai and Wuliangye, sa wquarterly prepaid income hit a three-year high, indicating the growth momentum continues. Wuliangyi also raised its average sellingprices 3%, with effect from 26 Mar 2016. The increase in ASP is due mainly to strong demand for its products. Chinese investo rs areregaining confidence in the liquor sector, especially Chinese spirits, despite the economic slowdown. We believe that growth in thesector will continue, given rising disposal income.

HK-listed names also outperformed. The HK-listed liquor-related names include China Food [0560.HK], Silverbase [0886.HK], Tenwow[1219.HK] and Tontine Wines [0389.HK], whose average share price performance was 1.4%, 15.0 and -9.7 on a one-month,three-month and six-month basis, also outperforming both the Hang Seng Index and the HSCEI. Their share price outperformance, inour view, is due partly to fact that the market is treating them as a proxy for A-share listed liquor names.

Tenwow has been transforming into an own-brand manufacturer since 2010. Tenwow’s top-line contribution from its own-brand productsincreased from 23% in 2010 to 44% in 2015. The own-brand products offer a higher gross profit margin (29.4% in 2015) thanthird party brands (10.8%). Because of its transformation, Tenwow’s blended gross margin increased from 9.2% in 2010 to 18.7% in2015. Tenwow management believes that the Company’s blended gross margin will continue to improve going forward with a risingtop-line contribution from own-brand segment. In Apr 2016, Tenwow agreed to sell 2% of Nanpu to Shanghai Tangjiu, reducing Tenwow’sstake in Nanpu to 49%. This reduced stake will help Tenwow relieve market concerns about connected transactions with Nanpu.

Third-party branded alcoholic beverages accounted for 40% of Tenwow’s total revenue, with products including spirits, wine, Chinesewine and beer from a wide range of international and domestic brands, such as Martell, Hennessy, Remy Martin, Carlo Rossi,Imperial Court and Maotai. Turnover of this segment declined 20.4% YoY to RMB1,963m in 2015, as the Company continued to adjustand optimize its third-party brand portfolio. The gross profit of this segment also declined by 0.2ppt YoY to 12.3% in 2015 . Tenwowmanagement believes that the adjustment period is over and that the third-party branded alcoholic segment is no longer a dragon top-line growth in 2016. Based on market consensus, Tenwow is currently trading at 8.6x 2016F PER, which is at a deep discountto its peer average of 16x. We believe Tenwow will also be one of the beneficiaries of growth in the liquor market in China. Tenwowcould be re-rated given margin expansion from an increasing share of its own-brand products sales, increasing interest in the liquorsector and declining connected transactions with Nanpu.

SilverBase is one of the largest distributors of Wuliangyi, and the Company is also benefitting from increasing contribution fromonline sales, which on average, accounted for 20% of total turnover in FY16. Management aims to increase the online sales portion to50% in FY17. We share the view that investors are still taking a cautious view on SilverBase given its volatile earnings rec ord. However,the turnaround in the whole baijin industry in China should partly remove investors’ concerns, and the coming annual resultsannouncement (its financial year ended in March) will provide a good opportunity for investors to re-assess SilverBase. The ASP hikeby Wuliangye is also positive for SilverBase.

HK,in2015,sharelistedliquornames,Tenwow,bothspiritsandwine