Asia Credit Strategy:Philippines~Wait &Watch

摘要: VotingongoingThecountryvotesaswewrite,butpolls(SWSandPulseAsia)haveputRodrigoDuterteasthefrontrunner

Voting ongoing

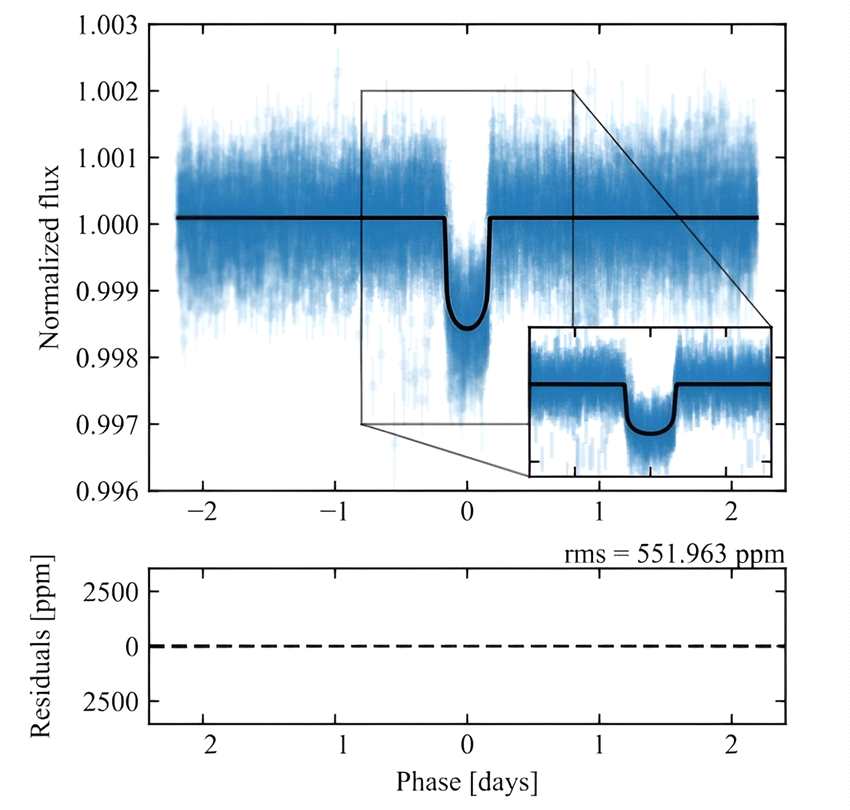

The country votes as we write, but polls (SWS and Pulse Asia) have putRodrigo Duterte as the front runner and they have correctly forecasted theeventual winner in the past four Presidential cycles. Markets were jitterycoming into this big event and Philippines' risk assets have underperformedacross the board (Figure 1). Relatively, currency has done the worst andequities the best, with credit somewhere in between. We think this willeventually be a buying opportunity, but the sell off so far has been from tightvaluations, hence we are watching from the sidelines and await Feblows/wides before re-assessing our view. Also, Philippines have been themarket's favourite for a while, so this short term adjustment could have morelegs from a positioning perspective.

What's next?

Only time can answer this question, but despite all the noise before elections,if Mr. Duterte does win as predicted by the polls, we believe his focus will beon what the country needs - infrastructure, eradication of poverty andcorruption, etc. Various DB research teams have argued before that whoeverwins the elections; it is unlikely to matter much as macroeconomicfundamentals (FDW remittance, BPO sector, et al) should stay intact amidstbroadly similar agendas of various political parties. Also, they would expect thenew president to take a hands-off, consultative approach to business - pleaserefer to notes from our economics and equity colleagues for more details. Nextevent to watch will be formation of the cabinet and announcements on thisshould start coming before the new President takes office on July 1. From acredit perspective, it will be important to also keep an eye on the fiscal policy -Philippines has run a very sound one in recent years, and significant increasesin expenditure or cuts in taxes could change that. We however don't expectany immediate credit rating actions (albeit Fitch does have a positive outlookon its BBB- rating).

Philippines credit strategy

Technicals for Philippines' credits have come under scanner for the first time ina long while. Within credit, Cash has underperformed CDS, and in cash,Sovereign has underperformed Corporates (Figure 2). The underperformance ofSovereign cash is perhaps explained by the fact that they are easier to shortand have an EM investor base (unlike corporates that are mainly held bylocal/Asian investors). The outperformance of CDS is slightly surprising to us.

In sovereign cash, the spread curve has flattened, with long endoutperforming. Amongst corporates, Vista Land has been the worst performerin our coverage, followed by ICTSI straights - the former arguably driven by itsrelatively weaker credit profile compared to other corporates, and the latterdriven by global growth concerns. San Miguel complex bonds have done well.

If the ongoing sell-off has more legs, we expect CDS, long end sovereign andcorporates to start catching up at some point, so we are slightly cautious onthese segments. As mentioned before, overall we are largely neutral on thePhilippines credit space and will wait for spreads to widen closer to Feb widesbefore considering going long, which implies another 20-25bp in CDS, 25-30bpin long end sovereign and 40-50bp in corporate cash. We are especially eyeingthe short end sovereign as it has widened the most from YTD tights so far,although it’s less liquid. We do acknowledge that valuations were quite tight inthis space before the latest round of underperformance. Also, Philippines hasbeen a very consensus Overweight in investor portfolios across the board,hence positioning is possibly quite extreme and might take a while to adjust. Inthe mean time, we will stay cognizant of the historically strong local bid.

Also,25,VotingongoingThecountryvotesaswewrite,butpolls,SWSandPulseAsia