GEMs Equity Strategy:Saudi Arabia’s equity market reforms

摘要: Followingtheannouncementof“Vision2030”on25April,SaudiArabianauthoritieshaveannounced,overthelasttwod

Following the announcement of “Vision 2030” on 25 April, Saudi Arabian authoritieshave announced, over the last two days, several reforms aimed at improving thecountry’s equity markets. These reforms were aimed at easing foreign ownershipregulations, improving equity market infrastructure and thereby making steps towarda potential reclassification to “Emerging Market” status by equity index providers likeMSCI. Based on the new foreign ownership rules, we estimate that Saudi Arabiacould make up to 3.2% - 4.0% of MSCI EM depending on the potential listing ofSaudi Arabian Oil Co. (Aramco).

Reforms to encourage foreign participation

Definition of Qualified Foreign Investors (QFI) expanded to include financialinstitutions such as sovereign wealth funds and university endowments aswell as banks4 Minimum Assets under Management (AuM) threshold for QFIs reduced toUSD1bn from USD5bn4 Foreign ownership level (FOL) pushed up to 49% of company’s capital. Howeverthis is conditional upon company’s bylaws or any other regulations allowing this.

Individual QFIs can now own up to 10% (5% earlier) of the company’s capital.

New regulations aimed at improving the equity market infrastructure

Capital Market Authority (CMA) approved to amend the settlement cycle to withintwo subsequent working days of trade execution (T +2). This is likely to beimplemented in the first half of 2017.

Elimination of cash prefunding requirement by the exchange, activation ofcovered short selling with the ability to lend and borrow securities, enhancedcustody controls and the introduction of proper delivery versus payment (DVP)and collateralization setup.

Reclassification to an “Emerging Market” status

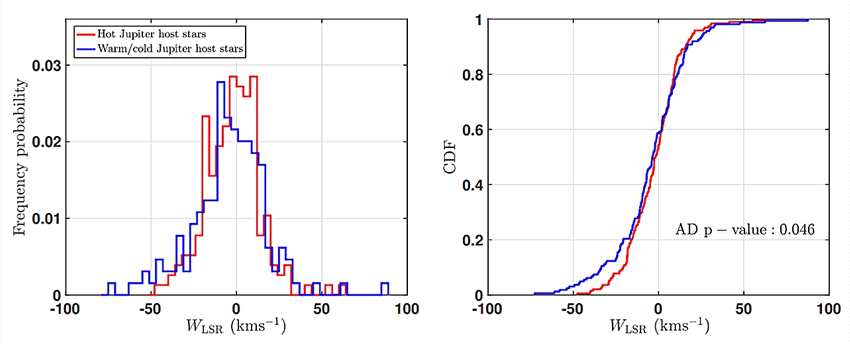

All these moves are likely to play into Saudi Arabia’s objective of being classified asan EM by index providers such as MSCI. We estimate that the weight of Saudi Arabiacould be 3.2%, based on the new FOL regime. However, this could go up to 4.0%,conditional upon the Saudi Aramco listing. On the following page, we presentsimulated MSCI EM index compositions under four scenarios.

EmergingMarket,scapital,Followingtheannouncementof,Vision2030,on25April