Flash Notes:RBNZ Holds Interest Rate

摘要: TheReserveBankofNewZealand(RBNZ)earlierthismorningkepttheOCRunchangedat3.50%,asexpected.Ofsignifican

The Reserve Bank of New Zealand (RBNZ) earlier this morning kept the OCR unchanged at 3.50%, as expected. Of significancewas the final paragraph in the statement issued by Governor Graeme Wheeler, signaling the RBNZ’s intention not to join inthe race like other central banks around the world of late, at least not yet. However, “future interest rate adjustments, eitherup or down, will depend on the emerging flow of economic data”, according to Wheeler.

The official statement saw significant downward revisions to the outlook for inflation, largely reflecting the sharp fall inoil prices. CPI inflation is forecast to be 0.0% for 2015 and 1.3% for 2016 (compared with 1.1% and 1.7% in the December2014 statement). GDP forecasts were also adjusted a little, mostly reflecting revisions to the historical GDP numbers. GDPgrowth is forecast to be above trend over the next two years at 3.2% for 2015 and 3.5% for 2016 (compared with 3.5% and3.1% in the December 2014 statement).

The previous warnings about the high NZD exchange rate was repeated. The central bank indicated that “On a tradeweightedbasis, the New Zealand dollar remains unjustifiably high and unsustainable in terms of New Zealand’s long-termeconomic fundamentals. A substantial downward correction in the real exchange rate is needed to put New Zealand’sexternal accounts on a more sustainable footing.”

In all, we think the RBNZ appears to be comfortable on hold for now. With growth still running above trend in New Zealandand expected to remain strong, we are keeping to our view that the RBNZ’s next move is more likely to be up than down.

However, we bear in mind that it does have the room to lower interest rates if it wants to, and a key trigger for a rate cutwould be a further sharp fall in domestic inflation expectations.

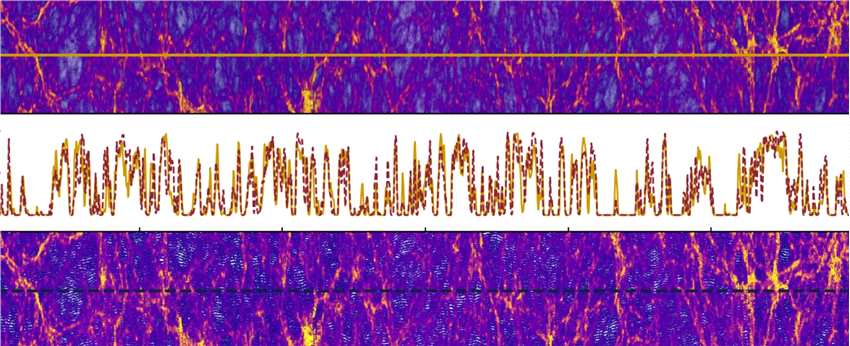

NZD/USD was soft prior to the announcement, but subsequently rallied after the RBNZ opted to keep rates unchanged,attaining highs of 0.7321, up from Wednesday’s lows of 0.7192. Over the last two sessions, the Kiwi had been under downwardpressure from continued strength in the US dollar and fallout from the 1080 formula contamination scare. Further out,there is reason to believe that NZD/USD will move lower. A large part of the currency’s weakness is expected to be due toincreasing US dollar strength, where the story of rising US interest rates is likely to dominate currency trades. Followingtoday’s monetary policy decision, we are maintaining our forecasts as shown below:

for,and,However,2015,2016